Stock Market Launch /

Initial Public Offering (IPO)

Advice and Assistance

"Stock market entry is regarded as the royal road in business development. Nonetheless the opportunities and risks must be carefully weighed and the individual steps must be based on careful planning and systematically and professionally executed."

(Dr. Joachim Kaske, former Executive Director U.C.A.)

An important precondition for a successful IPO is comprehensive advice and assistance before, during and after the stock market launch.

For the companies that are its clients, U.C.A. effects the best possible combination of issuing price and issuing conditions. U.C.A.'s independence is seen here as an advantage, as is the neutrality in the selection of partners for the stock market entry.

> More informations

U.C.A. accompanies firms during:

-

Preliminary examination

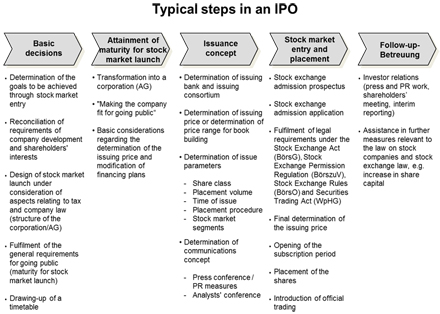

While preparing the stock market launch, a detailed examination of the company's maturity with regard to going public will be carried out. If necessary, clear and transparent corporate structures must be established and a number of aspects relating to tax and company law and financial matters must be clarified.

-

Investment

In order to establish the necessary endowment with equity in order to achieve maturity for stock market entry, many stock market candidates require a financial partner who participates temporarily in the company.

-

Transformation into a corporation (AG)

U.C.A. supports the company through its partners, lawyers and auditors, during the changeover of corporate form into a corporation (AG).

-

Stock market entry

The large number of partners - banks and issuing houses - creates a competitive situation with regard to the issuing price and the terms of issue. The partners of U.C.A. will realise the financing of the company on the stock exchange. In addition to the execution of the stock exchange application procedures this also means in particular the selection of the appropriate stock exchange segment and the type of share. Through the takeover and placement of the shares by an issuing house the company is guaranteed a fixed price.

-

Coordination

During the stock exchange entry process U.C.A. serves the company as a central contact point, so that all the groups involved, including auditors, tax advisers, banks, stockbrokers, lawyers, notaries and the stock exchange admissions office can be coordinated effectively. This guarantees adequate consideration and harmonisation of the individual interests at all times.

-

Pre-Marketing and Post-Marketing

A particular feature of the services offered by U.C.A. is the pre-marketing and post-marketing of the shares of an IPO candidate, during which U.C.A. can draw on its well-founded knowledge of the capital markets.: In good time before the stock market entry and at regular intervals after the IPO, U.C.A. stages so-called road-shows to present companies and management to independent funds in Frankfurt, London, Paris and Zurich. It thereby achieves not only a high placement security for the proposed new share issue but also a positive development of the share price following market entry.

-

Increase in capital

In the case of planned additional increases in capital in our holdings, U.C.A. is available to assist in the placement process with suitable investors.