Mergers & Acquisitions

(Company Sales / Purchase)

M&A using the example of the sale of a company:

"The realisation of the optimal sales price is not only a question of the object for sale. Generally it is approaching the right partner and adopting the best negotiating strategy which will determine whether the price the company realises corresponds to its value - or ideally even exceeds it."

The number of corporate sales has risen considerably in recent years for the following reasons:

- Problems affecting succession in the case of family firms.

- Insufficient shareholders' equity to withstand the global competition pressure, especially in the case of medium-sized firms.

- Consortia and concerns which dispose of subsidiary companies and business areas during the course of outsourcing processes.

Since the sale of a company is a non-recurring procedure for most businessmen and managers, they are unable to prepare themselves adequately for the sales process. This leads to a series of demands and problems which can all too easily result in the businessman or the management finding themselves out of their depth:

- The sales process demands time and emotional energy in addition to that required for the day-to-day operations of the company.

- The businessman or manager frequently knows very few companies which might be interested in his own company. They are primarily to be found among his direct competitors. He frequently lacks the capacity and expertise to undertake complete research into potential interested parties.

- Many businessmen and managers lack the negotiating experience relating to company sales which is necessary in order to realise the maximal corporate value.

Since even small errors in the sales process can have serious results which will affect in particular the financial outcome, it is recommended that in such a situation the assistance of M&A specialists like U.C.A. be enlisted for the following reasons:

- The businessman and/ or the management will be relieved of the extra duties; this means that they will not need to draw on any additional resources within the company in the form of teams or departments who will be required to focus on the sale of the company.

- Through market knowledge on the part of the M&A experts and special business databases, it is possible to investigate potential purchases thoroughly.

- Potential purchases can be approached anonymously through the use of an M&A company, so that the company need not reveal that it is looking for a purchaser at too early a stage.

- In general, M&A consultancy companies have better access to potential interest groups such as financial investors (investment companies or institutional investors).

- The use of the range of services provided during M&A consultation, for example, can be used in order to draw up an offering memorandum, to prepare the due diligence or to determine a negotiating strategy.

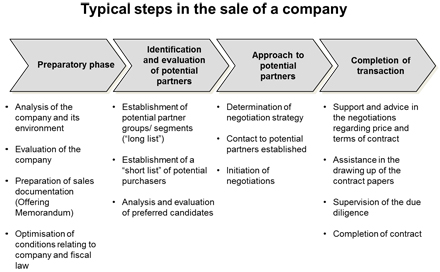

- U.C.A. has developed a structured sales process which ensures that the planned company sale proceeds in a professional manner and which provides expert advice in all phases of the transaction. Absolute priority is attached to the fact that the procedures are dealt with in complete confidence and in agreement with the client.